how much is renters credit on taxes

In California renters who make less than a certain amount currently 41641. The renters property tax refund program sometimes called the renters credit is a state-paid refund that provides tax relief to renters.

Efile Express Mn Property Tax Refund

120 credit if your are.

. Although it is nonrefundable the credit amount isnt that big. You must include 10000 in your income in the first year. Therefore no matter how much rent is paid only 10 of the rent can be claimed for the homestead property tax credit.

There is a cap on this amount however. Typically the deduction limit is set at 50 percent of the rent paid throughout the given tax year. What is the renters property tax refund program.

For questions about filing a renter credit claim contact us at. Massachusetts MA offers a credit to renters for up to 50 of your rent paid up to 3000 1500 per return if married filing separately as long as the rental property is your. Those found eligible for.

The amount of the renters tax credit will vary according to the relationship between the rent and income with the maximum allowable credit being 1000. Mail the completed form to. Taxpayers cannot deduct residential rent payments on your federal income.

Ask the insurer how much you would save by. A portion of your rent is used to pay property taxes. You or your spouseRDP were not given a property tax exemption during the tax year.

Low-income taxpayers with very inexpensive leases can benefit from a renters tax credit in New York. 60 credit if you are. Married filing separate taxpayers are limited to a rent deduction equal to 50 of the rent each pays and cannot exceed 1500 per return.

For 2022 the California Renters Credit is 60. In the first year you receive 5000 for the first years rent and 5000 as rent for the last year of the lease. To qualify you need to have a household gross income of 18000 or less.

You may qualify for a Renters Property Tax Refund depending on your income and rent paid. Plus if you have renters insurance you may also be eligible to deduct a portion of your premium. The marginal tax bracket you are in of which there are 7 between 10 and 37 depends on your filing status and the amount of taxable income you report for the year.

So if your tax liability is 0 the credit will basically do nothing for you. Renters insurance deductibles often start at 250 but by increasing it to 1000 or more may save you on your renters policy. That being said each state has its own unique set of rules and we get into these specifics below.

In both Massachusetts and Indiana for. If your monthly rent is 1600 you can deduct 400 for your home office. The 500 tax credit in the case of a tenant renting a single room estimated at 621 per month in Dublin will equate to 67 of the annual rent or 80 of the monthly rent in.

In those states the tax credit tends to be a negligible amount often 60 or 75 in total. The 500 per year relief has been backdated to 2022 so renters can apply for a double tax credit worth 1000 at the end of this year. Vermont Department of Taxes.

However a married couple filing. Renters Property Tax Refund. You can find out if a property is service fee or tax exempt.

Little Known Tax Advantage Benefits Minnesota Businesses Finance Commerce

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

California Bill Would Boost Renter Tax Credit For First Time In 40 Years Kqed

Is Renters Insurance Tax Deductible

11 States That Give Renters A Tax Credit

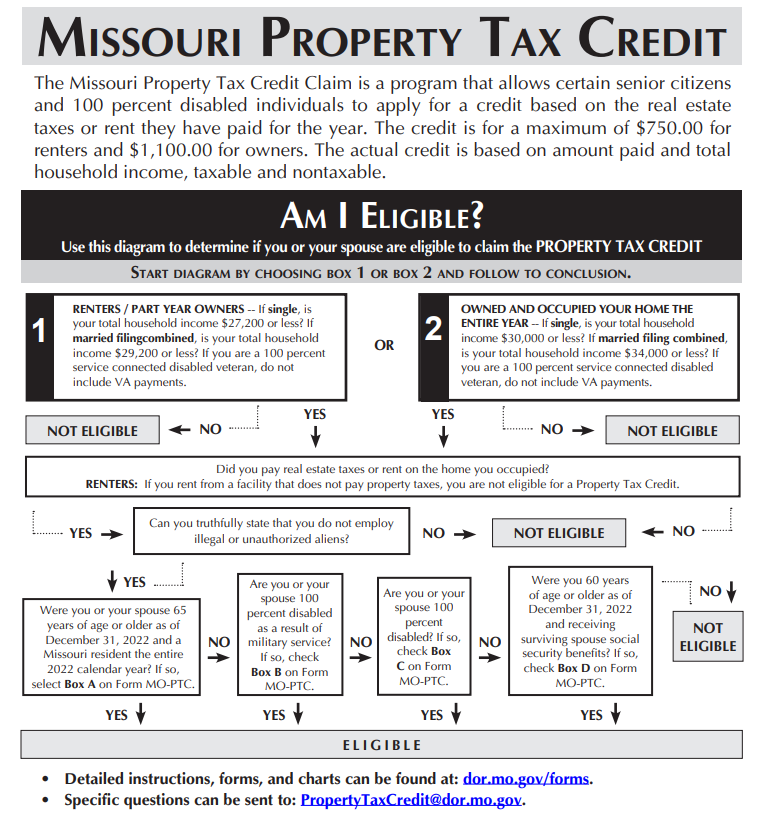

Property Tax Claim Eligibility

Low Income Housing Tax Credit Could Do More To Expand Opportunity For Poor Families Center On Budget And Policy Priorities

Are You A Renter In D C You Could Qualify For A Refund With This Tax Credit The Washington Post

Landlord Certificates Department Of Taxes

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

4 Things Landlords Should Know To Big Save At Tax Season Smartmove

Taxes Kansas Action For Children

Can A Renter Claim Property Tax Credits Or Deductions In California

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Don T Miss Out On This Money The Property Tax Credit And The Renter Credit Renter Rebate Vtlawhelp Org

How To Take Advantage Of Education Tax Credits Forbes Advisor

How Poor Credit Could Raise Your Renters Insurance Rates Nerdwallet

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com